Whether you’re looking to secure $5,000, $50,000, $500,000 or $5 million for your business, you’ll need a business plan. Knowing how to write a business plan that captures the attention of lenders and investors can pay big. While entrepreneurs and startup owners often feel overwhelmed at the thought of writing a business plan, don’t worry, we walk you through what a prospective lender or investor expects in this step-by-step guide. Better yet, it’s based on 20 years of experience helping companies, just like yours, not only create their business plan, but land their ideal funding arrangement and improve their strategies for long-term success. If you read this article and still feel overwhelmed, using the best business plan template is likely a good choice.

Your business plan highlights your unique value to the market, your strategy for business success and your financial outlook. It communicates that your business is meeting a need for which there is a demand. It conveys that your product or service demand is sustainable and your business is uniquely positioned to capture an increasing share of the market year-over-year. That means consistent business growth and profitability. This is achieved by describing your company, your product or service and your marketing strategy. Within your business plan, you’ll also specify your funding request and provide financial reports including projections.

Your business plan highlights your unique value to the market, your strategy for business success and your financial outlook. It communicates that your business is meeting a need for which there is a demand. It conveys that your product or service demand is sustainable and your business is uniquely positioned to capture an increasing share of the market year-over-year. That means consistent business growth and profitability. This is achieved by describing your company, your product or service and your marketing strategy. Within your business plan, you’ll also specify your funding request and provide financial reports including projections.

Writing a Business Plan

The following is an overview of each segment of a business plan and how to confidently craft the document to showcase a business strategy.

You can also download our how to write a business plan PDF to help you get started.

1. Executive Summary

An executive summary is where you impress the reader by highlighting a businesses’ market strengths and qualities. In one-to-two pages, establish a reason for the investor or lender to consider your funding request. Because the executive summary is an overview, you’ll write it last. This way you are consolidating the key messages from throughout the plan in one place.

An effective business plan executive summary defines your mission and lays out your strategy for success. It communicates that you have a firm grasp of the market. It also explains what you expect from the reader. But most of all, it captivates the reader’s attention and persuades them to strongly consider becoming your funding source.

2. Company Analysis

Now it’s time to describe the nuts and bolts of your venture through a company description and analysis. Investors are interested in your company’s mission, history, structure and achievements. They are assessing who you are and what your capabilities are. The mission statement within your business plan summarizes why you are operating and describes the effect your company has on its clients and in society. Mission statements are short and impactful. A mission statement for a new day care center might read: At XYZ Day Care, our mission is to care for children from tot to toddler in a safe, fun and loving environment.

A company history includes some basic information such as your inception date and location. The value of this section of your business plan lies in sharing your origin story. Investors are interested in knowing how you developed the business concept and took it to market. For start-ups, this section may be brief. Established organizations can expand this section to highlight major accomplishments since inception.

Here’s an example of a company history for a restaurant:

You’ll also specify the legal structure of your company in the company analysis. A business can be a sole-proprietorship, a partnership, a corporation, a limited liability firm or a non-profit organization.

3. Industry Analysis

Your company is not operating in a vacuum, and your business plan needs to reflect that through a market analysis business plan. There are socio-economic factors that have implications for your business’ performance in the marketplace. An industry analysis or market analysis sheds light at a local, national or global level of how all firms offering similar products or services are performing. This section identifies historical trends that have shaped the industry and pinpoints recent developments that must be considered when creating your business strategy. Research from credible sources is central to your industry analysis. Review both past and present reports to form the broadest understanding of all external factors.

Some key statistics to include in the market analysis section of your business plan are:

- total market size

- relevant market size

- historical market growth

- future growth estimates

You’ll also want to include your market share estimates. While many sources provide a total market size, it may take some additional work to calculate the relevant market size. That’s because this figure is based upon your niche rather than the entire industry market.

Your relevant market size is an estimate of the annual revenue your business could attain if it realized 100% market share. You calculate it by multiplying the following two figures:

- Estimate the number of people who might be interested in purchasing your products or services each year.

- Estimate the dollar amount these customers might be willing to spend, on an annual basis, on your products or services.

Let’s look at a partial industry analysis example for a startup food truck business:

4. Customer Analysis

An effective customer analysis describes your target market, whether a business or consumer, and their specific needs. For starters, a potential funding source is ascertaining how well you understand the buying behaviors and patterns of your customers. They are also assessing the proximity of your business to the customers and the size of the potential customer pool.

In addition, the customer analysis section of your business plan answers two key questions: what is the problem your customer is experiencing and how are you solving it? Customer problems, or pain points, are myriad. You’ll need to hone in on the vital ones you are resolving with your products and services. For example, customers may be looking to reduce time or costs to complete projects, or they may want to work with an organization that has a good reputation for customer service.

One approach to writing your customer analysis is to develop an ideal client avatar or persona. An avatar is a figure that represents your client. It defines their age (or years in business), behaviors, values, aspirations, needs and concerns.

Here’s a potential client avatar for a nail salon business:

5. Competitive Analysis

As previously mentioned, your business is not operating in a vacuum. There are other firms, competing for your ideal client, offering similar products and services. That’s why you need a competitive analysis business plan. A crucial section for a small business, startup or entrepreneur, the competitive analysis outlays your strengths as compared to other firms. It unequivocally answers the question, “why this business?” for prospective customers and more importantly potential investors or lenders.

The competitive analysis communicates how you will outperform the competition. This is the place for you to highlight your advantages – your strengths and the opportunities you can seize in the marketplace. Keep in mind that your strengths can be related to people, products, services, processes as well as intellectual property.

Competitors can be direct or indirect. A direct competitor offers a similar product or service to satisfy a customer need. An indirect competitor offers a different product, service or approach that may meet the same customer need as your business. For instance, an indirect competitor for a coffee shop could be a gas station, fast food restaurant or a donut shop.

To write your competitive analysis, you may prepare a competitor profile or a matrix. The profile focuses on a single company while the matrix provides a high-level comparison of the revenues, products, services, pricing, strengths and weaknesses for each key competitor.

Here’s an example of a competitor profile for a real estate agent:

6. Marketing Plan

Let’s face it, people need to know that your business exists. People also need to know the benefits of your products and services. A sales and marketing section or marketing plan section is where your marketing and sales plan is showcased within your business plan. A marketing plan lays out your strategy for communicating this information. It convinces investors and lenders that you know how to reach your ideal client and generate sales. In some cases, your marketing plan may be a separate document from your business plan.

The marketing plan has three components: products and services, promotions and distribution. Begin with thoroughly defining your products and services. Spell out the features and benefits. Features are the attributes of your product and service, while benefits communicate the value of your product or service to the customer. Be sure to also include your pricing in this section.

A marketing plan for a coffee shop could list coffee, espresso and tea as its products. The shop may sell additional products such as mugs, coasters, pastries and sandwiches. A beauty salon may have shampoo, dry, trim and curl as its primary services. They may provide complementary services including manicures, pedicures and eyebrow waxing.

Once your products and services are defined. You’ll focus on getting the word out. This is your promotion plan – your strategy for attracting customers. Are you using social media or content marketing? Are you advertising, and if so what are the best advertising channels for your business? Will you have periodic sales and product giveaways? What about referral bonuses? What market segment are you going to target with what promotional activity? In developing your promotional plan within your business plan, make sure you convey which channels are most effective for your ideal client. A strong marketing and promotional can be a source of the important competitive advantages you need.

Promotions are how you communicate. Distribution is how you sell. You need both to succeed in business. So now that you’ve laid out your promotion plan, it’s time to focus on getting your products and services to the client. Three common distribution channels are retail, wholesale and direct. In retail and wholesale distribution, you are selling your product to another entity who then sells to the customer. Your strategy should include how you’ll best fulfill the needs of your select retailers and wholesalers.

With direct distribution, the customer buys from you either online, by telephone or at your physical location. When developing your distribution plan, study the purchasing tendencies of your ideal client. Do they shop in certain geographies? Are they primarily online shoppers? How long will it take for the package to arrive? Armed with this information, you can effectively determine which distribution mode will get you the greatest results.

Consider an example from ABC Planners, an e-commerce business:

7. Operations Plan

Successful businesses have a strong operations foundation. As a result, the operations plan is a key part of the business planning process and business plan.

Defined processes, metrics and milestones are essential to ensure you will effectively manage the business and its associated costs. A thorough operations plan conveys to investors your business results are intentional. It also demonstrates you’ve considered what could go wrong and have preventative and recovery plans intact.

The operations plan can cover a number of functions from human resources and product development to legal. Your business operations are interconnected. Each operation supports how you sell your product or service. Give adequate attention to your production process and quality control. Production describes how you make your product or service. Quality control measures how effectively and efficiently you produce your product or deliver your service. Depending on the size of your business, some of the functions may be outsourced to specialty providers. In this case, you may list your suppliers.

Strategic planning is an internal part of operations. Here’s where you’ll detail your key milestones for the next three years. Milestones can be related to all aspects of your business: financial, products and services as well as operations.

A sample operations plan for a start-up bakery follows:

- Secure building lease by month, year

- Remodel space for modern bakery operations by month, year

- Hire bakery manager and staff by month, year

- Achieve $xx in sales by month, year

8. Management Team

Just as investors want to be assured you have a viable product or service, they are especially interested in who’s running the business. Plans spell out your intentions, and it is the management team business plan that provides a comprehensive roadmap for achieving those intentions. People carry out those plans. The caliber of your team and business partners conveys a great deal about your ability to achieve your business goals. That’s why investors need to know who’s on the team and what expertise they bring to the table.

Here you’ll provide the names and biographies of your management team members and indicate any management gaps. If it applies, you may also highlight your Board of Directors. The background information may contain the individual’s educational achievements, relevant work experience, skills and accomplishments. Sharing personal details helps investors to get to know your management team and provides another layer of transparency. According to the Small Business Administration, some business plans, may also include supplementary organization charts.

At the writing of your business plan, it’s possible to have openings on your management team. In this case, you’ll list the position, define the job responsibilities and specify the hiring requirements for the ideal candidate.

For example, the background for a software company’s president may read:

9. Financial Plan

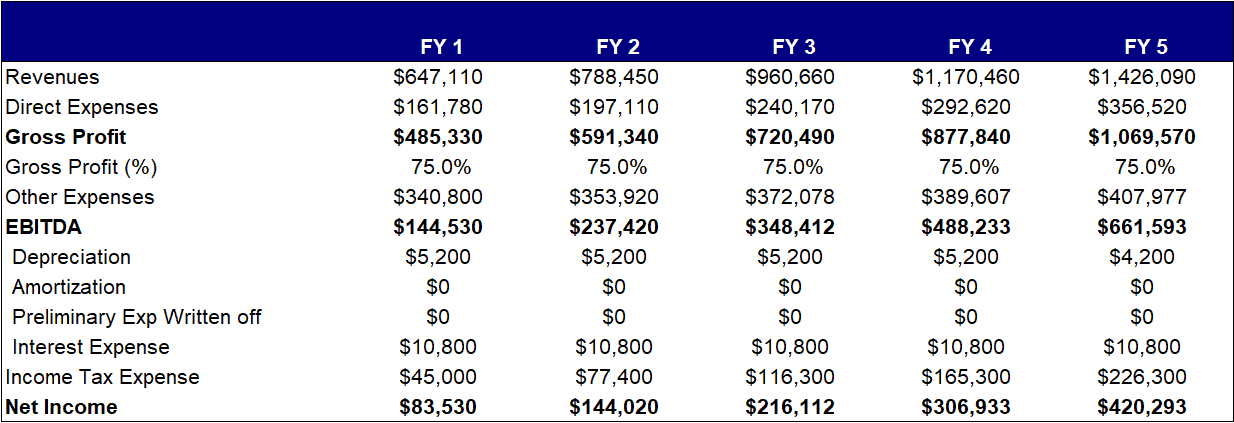

Remember, an important part of securing funding for your business is conveying it will be financially sound and you can repay the potential funding source in the near future. This is why the financial plan is critical to your business plan. It presents your revenue model, financial projections and funding requirements. You are basically sharing the different ways you will generate income, your plans for financial solvency and your rationale for your funding request.

The revenue model describes how you make money. Some common revenue models are subscriptions, advertising, affiliate marketing, markups, direct sales and commissions.

Financial highlights are essential. Your plan must include a three-to-five-year financial forecast that presents your projected income and expenses while painting a realistic picture of your profitability. It will highlight several reports with the details included in your Appendix. The financial reports include your projected income statement, balance sheet and cash flow statement. Established businesses may choose to include historical financial data. Charts and graphs work well for depicting your financial highlights.

Lastly, you will detail your funding request. Specify how much funding you’ll require and how you will use the funding. Some potential uses are to purchase equipment, pay bills and salaries, rent office space or conduct marketing research for product development.

Here’s an example financial plan summary:

10. Appendix

The Appendix is the final section of your business plan. It’s used to provide supporting documentation for materials referenced in any of the previous sections. Additionally, it allows the reader to review detailed financials. Investors expect to see your full financial forecast in the Appendix. These are the projected income statement, balance sheet and cash flow statement referenced in your financial plan. Some lenders may request your personal or business credit history as part of the appendix business plan.

Investors also use this section to verify your business idea and business credentials. Consider including some of these items in your Appendix: resumes for the management team, sample marketing materials, lists of key customers, patents and trademarks in the section.

How to Write a Business Plan Video

Summary of How to Write a Business Plan

We’ve just covered 10 essential sections of a complete business plan. By now you should be confident that you understand what you need to build a business plan and what investors look for in a traditional business plan and that you can write one to meet their needs. Just in case you’d like some additional information or examples, check out additional articles and resources covering topics such as marketing and sales plans, financial health, business plan market research, or try a business plan builder.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Easy-To-Use Business Plan Template

Easy-To-Use Business Plan Template 200+ Example Business Plans

200+ Example Business Plans Expert Business Plan Consultant

Expert Business Plan Consultant The Perfect Business Plan Outline for a Great Plan

The Perfect Business Plan Outline for a Great Plan Use This Business Plan Format to Expertly Write Your Plan

Use This Business Plan Format to Expertly Write Your Plan Growthink’s Expert Business Plan Writer

Growthink’s Expert Business Plan Writer 10 Key Components of a Business Plan

10 Key Components of a Business Plan How to Write a One Page Business Plan with Template

How to Write a One Page Business Plan with Template How to Write a Business Plan Executive Summary

How to Write a Business Plan Executive Summary What is a Business Plan?

What is a Business Plan? How to Write the Business Plan Management Team Section

How to Write the Business Plan Management Team Section Business Plan Software Options

Business Plan Software Options How Long Should a Business Plan Be?

How Long Should a Business Plan Be? Growthink Reviews

Growthink Reviews How To Write A Venture Capital Business Plan

How To Write A Venture Capital Business Plan