When seeking equity investments, the source of capital is, for the most part, tied to the stage of capital being raised.

You see, equity capital is raised in stages or rounds. The five main stages of investment include the following:

1. Pre-Seed Funding

2. Seed Funding

3. Early Stage Investment (Series A & B)

4. Later Stage Investment (Series C, D, and so on)

5. Mezzanine Financing

Most companies that raise equity capital and are eventually acquired or go public receive multiple rounds of financing first. Do you intend to go big before selling or becoming publicly-traded?

No right or wrong answer here, but if this is your vision then it’s important to consider when negotiating deal terms on earlier stage financing rounds. As Steven Covey said, you’ll want to “begin with the end in mind” and not make arrangements with your angel and/or early investors that will complicate later stages of funding.

If it’s not your plan to get venture capital down the road, then you’ll probably stop in Stage 2-receiving enough funding to boost your marketing, sales, and infrastructure to grow organically from there to the point where you are satisfied or ready to sell.

Finish Your Business Plan for Equity Funding in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

And know it’s in the exact format that equity funders like angel investors and venture capitalists want?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your equity funding business plan today.

Here are the five main stages of investing:

Stage #1: Pre-Seed Funding

Pre-seed funding refers to the initial capital a company brings in that comes from friends, family members, credit cards-whatever you can get. This could be as small as $5,000 and as high as $100,000.

Though the dollar amounts are lower, this round is more difficult to get institutional funding for (“institutional funding” is when a financial institution, rather than an individual person, funds you). Banks are not ready to make a Small Business loan on a company that has yet to launch, break even, or establish a track record.

Nevertheless, this is when you get the startup money to kick start your business with the bare essentials needed to begin making and fulfilling your first sales. Necessary machinery, an initial website, your first batch of inventory-things you can’t function without. Put everything else on your “wish list” to buy with revenues from sales or additional financing.

With this funding, the company often perfects its business plan and starts building its management team in order to position itself for its next round of funding. Your first year or two in business is where your dreams merge with reality and take a new form to guide your future efforts.

Many entrepreneurs end up taking their company in a different direction after some time spent testing your initial business model. Take the founder of Wrigley’s chewing gum, who began selling baking powder and soap door-to-door and giving away gum as a bonus before discovering people wanted it a lot more than soap.

So during this round, you’ll be testing what works and what doesn’t. Here, you prepare to scale up the things that do with future funding. It might even be a good thing to not have too much funding at this point of your business so you don’t invest too much going in a direction you’ll abandon later.

Stage #2: Seed Funding

Seed funding (also called seed capital) typically ranges from $100,000 to $500,000 and is often provided by angel investors, and is usually structured as convertible notes or common stock.

With seed funding, you hope to grow your business and, at the very least, gain proof of concept. That is, you’ll use the funding to build a product or service and prove that customers want to buy it. At this point, you will be ready for institutional investors who can provide funding to scale or rapidly grow your business.

Stage #3: Early Stage Investment (Series A & B)

“Series A” is the term used to describe the first round of institutional funding for a venture. The name is derived from the class of preferred stock investors receive in return for their capital.

The average Series A round is between $2 million and $5 million, with the expressed goals of funding early stage business operations. Providing enough capital for 1 to 2 years of operations, funds obtained from the Series A round can be used for the full gamut of needs-from product development and marketing to employee salaries.

Series B is the round that follows series A in early stage financing. In this round you can generally raise $5 million to $10 million, but can sometimes you can raise up to $20 million in capital or more.

Stage #4: Later Stage Investment (Series C, D, etc.)

Series C, D, etc. (some venture backed companies have raised over 10 rounds of financing) are further rounds of venture capital funding.

Each round may raise between $5 million and $20 million or more. Series C, D, etc. rounds are also typically obtained from venture capital firms and/or strategic/corporate investors.

Stage #5: Mezzanine Financing

Mezzanine capital, often provided by private equity firms, is capital provided either as equity, debt, or a convertible note that is provided to a company just prior to its Initial Public Offering.

Mezzanine investors generally take less risk, since the company is generally solid and poised to “cash out” relatively quickly.

Hopefully this lays out the different types of funding you can get and when. There’s no sense going after venture capital if the time isn’t right, or if it’s not needed to reach your vision. For most of my readers, the main concern will be preparing your business for angel financing until the time is right for venture capital.

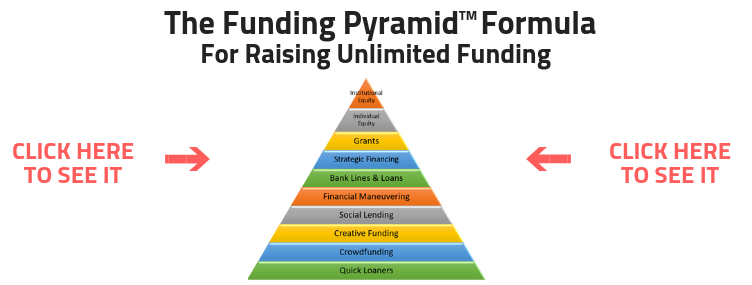

Raise Funding Quickly & Easily

If you’re struggling to raise money, it’s probably because your funding strategy is broken.

As I explain when you click, the key is to start at the bottom and work your way up the Funding Pyramid.