What is Value Attribution Bias?

Value attribution bias refers to the tendency to overestimate the value or quality of an item, person, or decision based solely on our perception of its worth or status.

In 2007, the Washington Post conducted an incredible experiment. The Post had world renowned violinist Joshua Bell play music in a popular Washington DC subway station.

What’s cool was that Bell was dressed casually; in jeans and a baseball cap, like most other street performers might.

But Bell was also playing a $3.5 MILLION violin. And he sounded incredible.

See the experiment for yourself below.

The Joshua Bell experiment set out to determine whether people would stop and listen and/or give money to the performer, particularly since the vast majority of them wouldn’t know who Bell was. But would they immediately recognize the quality of his music and stop?

Leonard Slatkin, music director of the National Symphony Orchestra, was sure people would stop. He expected that 10% of those who passed by would stop and that a crowd would gather. Surely this would occur for one of the greatest violinists alive.

But Slatkin was wrong. Very wrong.

During the 43 minutes in which Bell performed six classical pieces, 1,097 people walked by. Only 7 of them (0.6%) stopped what they were doing for at least a minute to listen, and only $32 was donated to Bell.

So, what does this experiment have to do with raising money for your business?

Let me explain.

The key principle at work here was “value attribution.” Value attribution is a psychological term that refers to the fact that our minds quickly assign value to people, objects and/or situations, and cause us to act appropriately.

For example, in Joshua Bell’s case, most passersby attributed very little value when they saw Bell in his jeans and baseball cap. Even though his music was incredible, he looked like any other street performer and was thus attributed little value in the minds of those who passed.

Another example that perhaps all of you can relate to is when you see something interesting in someone’s trash or at a flea market. For example, if you see a beautiful desk outside someone’s house about to be thrown away, how much value do you attribute to it? Most people immediately think there must be something wrong with it. Since its owner, by throwing it away, isn’t attributing any value to it.

So, let me explain where value attribution falls into raising money for your business. Value attribution also affects our perception of people. So if you contact an investor by yourself, their perception of you may be neutral or negative, and your chances of getting them really interested in funding you is relatively low.

Conversely, if you were introduced to that same investor by someone the investor respects, then their perception of you would be great, and your chances of funding much higher. In fact, an introduction from the right person could lead to such great value attribution that the investor writes you a check on the spot.

So the bottom line is that getting introductions and referrals to investors not only gets you in touch with those investors, but it starts the conversation off in an extremely positive light. And as the quality of the individuals who refer you grows, so does the perception of you, and thus your chances of raising money.

So right now, you should start making a list of people for which you have a lot of respect, and think investors respect. Get a meeting with them to discuss your business. Ideally ask them to be a member of your Advisory Board. And then request that they introduce you to investors they feel might be a good fit for you and your business. These introductions will get you great meetings. And the investors will attribute great value to you and your company, putting you in the best possible position to raise the money you need.

Raise Funding Quickly & Easily

If you’re struggling to raise money, it’s probably because your funding strategy is broken.

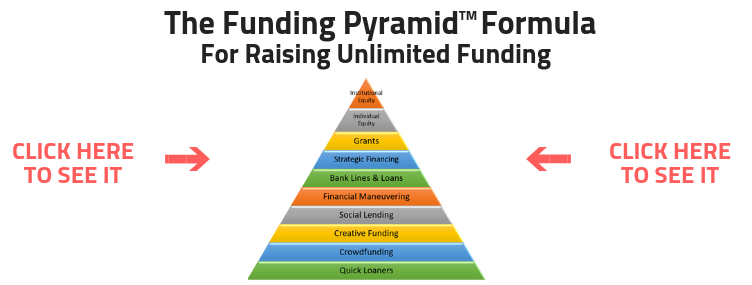

As I explain when you click, the key is to start at the bottom and work your way up the Funding Pyramid.